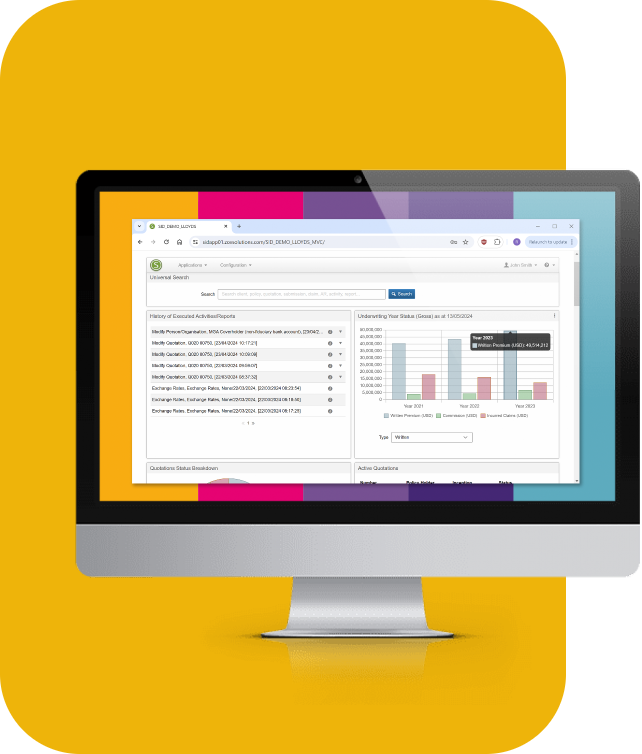

Meet SID

Our fully integrated, core software solution SID, gives accurate and immediate access to insights across the entire policy lifecycle and all P&C product lines.

To help you overcome complexities and navigate change, the comprehensive platform is highly configurable and designed to streamline and optimise every aspect of P&C insurance operations.

It supports any underwriting model. Business can be written direct, on a reinsurance or coinsurance basis, and subscribed under a binder in any currency, any language, and through multiple levels of intermediaries.

Whether you are large or small, local or global. No matter how complex the process. SID can help you succeed and scale with effortless efficiency.

Why choose SID?

Cost efficient and fast implementation

The comprehensive nature of the solution means that SID can support even the most complex insurance transactions and workflows – from underwriting to integrated policy, claims and finance administration.

As a web-based platform, SID is quick to set up and flexible enough to adapt to the specifics of your business. It runs on-premises or in the cloud – all you need is a browser, making it suitable for large or small, local or global businesses alike.

You won’t be starting from scratch. SID has evolved over two decades to meet the ever-increasing demands of the market and offers a wide range of functions and templates for companies of all sizes. These make deploying the system, designing processes and launching products highly efficient, with very little coding required.

Robust risk management

SID helps you manage risk and reputation, so you don’t need to fear the consequences of getting it wrong.

Data validation at every step ensures the integrity of information. Combined with comprehensive reporting options, you can be sure to make the right decision based on accurate data and insight.

Stringent security controls ensure access to activities, tasks, and information – including who can issue policies, quotes, pay claims, and more – is only available to authorised users.

SID administrators can set permission levels and enable two-factor authentication for even more control over system native and API users.

Scalable and futureproof

Navigating change isn’t easy but is inevitable. The flexible and highly configurable nature of SID means it can grow and adapt alongside your business needs – now and in the future.

It can support not only current requirements but is ready to scale up or down as you need new capabilities or to quickly respond to market or regulatory changes.

Whatever the requirement, SID can adapt and deliver, futureproofing your investment.

Key features and benefits

SID’s extensive functionality covers all core areas of P&C insurance operations.

Don't take our word for it...

What our customers are saying about us

Navigate the future

Navigate the future

Looking for a core platform solution for your complex insurance needs? Let’s chat.

"*" indicates required fields