As insurers move into 2025, the need for intense collaboration with numerous partners in sales, outsourcing and technology remains top of mind. From streamlining internal processes to enhancing customer service, today’s insurers are under increasing pressure to deliver efficiency and innovation as a team effort. Driving this collaborative efficiency requires a powerful core platform solution supported by Application Programming Interface (API) integrations.

APIs deliver the seamless connectivity that makes daily operations smoother, letting insurers manage data, scale services, and forge new partnerships with ease. This will rarely be about plug’n’play, but we should also be well beyond proprietary data exchange programming.

The backbone of modern insurance operations

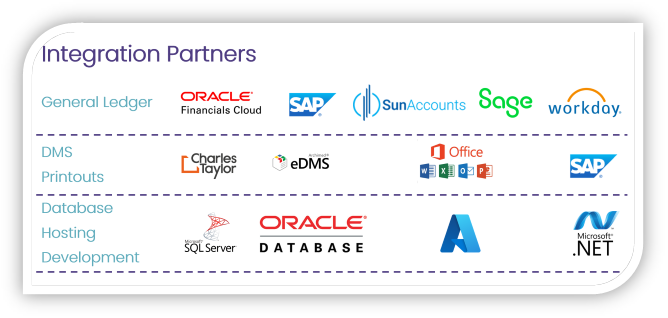

API integration supports essential software and services, expanding the capability of core platform solutions. For example, with APIs, insurers can integrate their Document Management System (DMS) with their core platform solution to support efficient policy and claims management by providing seamless access to necessary documents and files. This setup makes workflows smoother, allowing for more efficient file management and better organisation during processes that are document intensive.

Beyond document handling, API integrations facilitate streamlined data sharing with critical external systems, helping insurers maintain a single source of truth for all transactions. An API connected core platform solution enables the secure exchange of data with external claims data providers like Third-Party Administrators (TPAs) and coverholders, making it easier to maintain comprehensive records and ensure efficient claim resolution.

When insurers can connect smoothly with partner platforms and external data providers, they are better positioned to deliver a tailored, responsive service. Through API connections, insurers can facilitate real-time data updates across platforms, reducing delays and improving the transparency of transactions, all of which contribute to a stronger, more trust-driven customer relationship.

API integrations create endless opportunities for partnerships

Connectivity is not only crucial for established processes – it is increasingly useful for exploring the frontiers of innovation, such as AI-based applications and sources. A proven framework and experienced team are essential for providing a reliable foundation to explore and test innovation.

With APIs that seamlessly connect to third-party systems, a core platform solution empowers insurers to collaborate effortlessly with brokers and coverholders, providing access to comprehensive solutions without limiting them to a single system. These connections let insurers expand their offerings, enter new markets, and scale efficiently, creating a wide network of services that meets the diverse needs of their customers.

As insurers embrace API integration to propel growth, a robust core platform solution becomes essential for secure, scalable operations and seamless ecosystem partnerships. With its comprehensive capabilities, SID is built to meet these needs. SID’s rich off-the-shelf API framework enables smooth data exchange and secure file handling, integrating seamlessly with a range of systems – from regulatory bodies to DMS and broker platforms. These integrations create a powerful framework within SID, allowing for the creation of new connections when needed.

For insurers ready to expand their partnerships, improve internal efficiencies, and grow with confidence, our platform, SID, offers a proven, future-ready solution that positions them for success in an increasingly connected world.